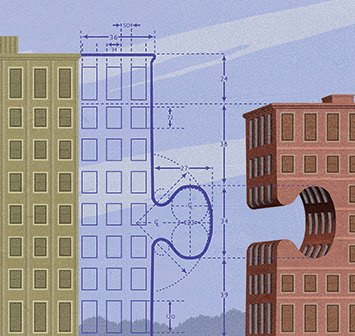

Building the Next OCIO Powerhouse

by charles | Comments are closed02/18/2021

Growing a discretionary asset management or investment advisor business is tough.

We have yet to see an independent Outsourced Chief Investment Officer firm reach $100 Billion AUM through organic growth.

Most of them will never even reach $20 Billion.

Of the thirteen firms managing $50 billion or more on our annual OCIO list, only one – Alan Biller and Associates – launched as a pure-play OCIO and consulting start-up. And they’re just over the $50 Billion line.

|

OCIO Over $100bn AUM |

AUM (as of 6-30-20) |

|

Mercer |

$305.9 |

|

Russell Investments |

$234.7 |

|

BlackRock |

$228.0 |

|

SEI |

$181.0 |

|

Goldman Sachs |

$168.0 |

|

AON Hewitt |

$162.7 |

|

Willis Towers Watson |

$148.0 |

|

State Street Global Advisors |

$145.6 |

|

|

$1,573.9 |

|

OCIO $50bn to $100bn AUM |

AUM (as of 6-30-20) |

|

Northern Trust |

$88.7 |

|

Wilshire Associates |

$73.4 |

|

JP Morgan Asset Mgmt |

$63.3 |

|

Vanguard |

$57.0 |

|

Alan Biller and Associates |

$51.1 |

|

|

$333.5 |

Total OCIO assets have been growing briskly, at more than 15 percent annually (In the 12 months July 2019 to June 2020).Most except Biller began as financial mega-firms long before OCIOs were even invented. Several have roots stretching far back into the nineteenth century. JPM goes all the way back to the 1800s!

Independent OCIOs and RIAs have not been able to grow their way into this select company, and probably never will.

Why is this?

But it’s scattered among dozens of relatively small firms.

The solution seems obvious: Do it the old-fashioned way. Grow by acquisition and aggregation. Buy, sell, and merge firms. That’s how the mega-financials have done it.

It’s a well-understood historical process. Railways, utilities, steelmakers, banks, brewers, hotels, airlines all grew like this.

The boffins at Harvard Business School call it the Industry Consolidation Lifecycle. (See: https://hbr.org/2002/12/the-consolidation-curve) It’s easy to see after the fact, but much harder when we’re all floundering through it in real time.

And yet, for most OCIOs under $50 Billion, there seems to be a deep aversion to mergin’.

Read More »Northwestern Lands CIO Amy Falls

by charles | Comments are closed02/02/2021

Almost exactly ten years ago we reported with great interest Amy Falls’ move from Chief Investment Officer at Phillips Academy (aka Phillips Andover) to the CIO job at Rockefeller University.

Five years ago we interviewed Ms. Falls in Manhattan and marked her as someone to watch when a top-tier endowment position opened up. (See “Coffee with Amy” below.)

Now, it has just been announced that she’ll be moving on to Northwestern University. She’ll lead their $12.2 billion endowment, succeeding William McLean as CIO.

Clearly she impressed Northwestern’s search committee by leading the Rockefeller endowment to consistently excellent performance.

But not everyone may have noticed just how excellent it was.

By our reckoning she is in the top 10 among all US endowments over those ten years – ranking ninth out of ten to be exact.

Paula Volent at Bowdoin ranks first for 2011-2020, with 11.6 percent.

All the other endowment big guns (MIT, Yale, Dartmouth, Princeton, Williams, Notre Dame, Brown, Carnegie Mellon) and their renowned CIOs are strung out between 11.4 and 9.5 percent for ten years. Ms. Falls squeezed past Debbie Kuenstner at Wellesley with 9.6 percent.

But she was even more impressive in the second half of her decade at Rockefeller.

As she increasingly put her own stamp on their allocations, she surged even closer to the top of the pack.

Over the last five years, 2016-2020, her return tied with Paula Volent at Bowdoin for third-ranking among all US (and Canadian!) endowments with 8.5 percent. They were surpassed only by Brown and MIT, with 9.8 and 9.0 percent, respectively.

As she has moved up to head bigger funds her comp has grown proportionately.

She made about $800K at Andover. At Rockefeller her pay rose to about $1.5 million by 2020. And now, at Northwestern, we estimate that her comp will be well north of $2 million.

Amy’s Excellent Network

Read More »