Latest 5-year Endowment Performance

by charles | Comments are closed02/07/2019

Five-year endowment performance:

Behind the NACUBO numbers

This February has been a rough one for weather in much of the USA, but two events this month should bring a little sunshine our way.

First, NACUBO rolled out their annual endowment study: the semi-official league tables for endowment investors. Then, next week, NACUBO and TIAA will host their conference in New York where presenters and attendees will ponder the numbers.

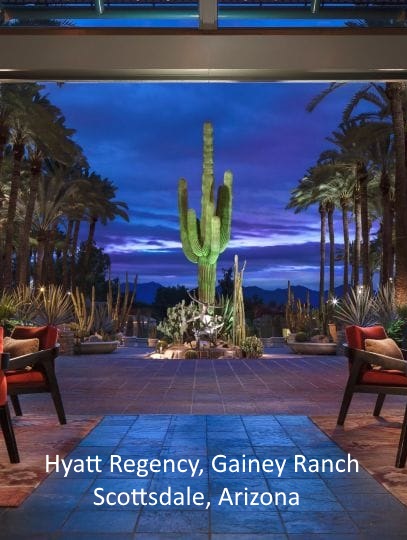

In between, we have Nancy Szigethy’s always engaging NMS Investment Forum in Scottsdale, Arizona. It’s at the Hyatt Regency Gainey Ranch, February 9-12, 2019 – an event which draws top endowment and foundation leaders for camaraderie and Arizona sunshine.

Scottsdale is only a quick drive up the I-10 from our new home in Tucson. So, if you’re planning to attend NMS, shoot me an email at skorina@charlesskorina.com and say hello. You never know which Hyatt lounge I might find myself in this weekend.

————————————————–

Endowment performance: a few observations

Our SEER report (Skorina’s Enhanced Endowment Report) is enhanced because we disclose performance of individual endowments, which NACUBO is not permitted to do.

This update offers 5-year investment returns for 61 endowments for FY2018. We consider the 5-year return the most meaningful for comparing the performance of endowments and their chief investment officers.

We’ll publish our complete list of CIOs and more detailed commentary when all the returns are in and computed by our clever but overworked staff.

We recruit chief investment officers for a living, so we avidly follow all the US universities and colleges with AUM over $1 billion (and many with less) – and we advise board members, families, and management on investment performance and executive compensation.

Where are the women?

Considering the number of highly-qualified female investment professionals we encounter every day, they are still a distinct minority in the top jobs. Something is obviously not working in the hiring and promotion process.

Our SEER list below includes 15 women among the 58 individual (non-OCIO) chief investment officers.

That’s 26 percent, which doesn’t sound too bad. But the picture is much worse in the larger universe of big-endowment CIOs. There, the percentage is only about 15 percent, and that’s down over recent years.

But we can at least highlight those 15 in their own list, which we’ve added down below.

Read More »