The Family Office: Fast and Flourishing

by charles | Comments are closed06/27/2021

According to Forbes, there are a record 493 new billionaires on the latest “Richest in 2021” list, of which 10 hit the jackpot through SPAC mergers and 60 from IPOs. Sooner or later, some of them will establish a single-family office.

They will be in good company. Oprah has one. Gates has one. The Pritzkers and Waltons have half-a-dozen. But why would someone who has just made a fortune want to hire a room full of advisors to tell them what to do with their money?

Probably because, just like the rest of us, most newly-flush fortunaires worry about their wealth and how to manage it.

Even John D. Rockefeller had worries.

The Rockefeller family office and philanthropic endeavors are legendary role-models for modern philanthropists and family wealth managers.

But, as Ron Chernow points out in “Titan”, his definitive biography on Mr. Rockefeller, John D. worried constantly about his wealth and his philanthropy. So he created a structure and hired experts to deal with the demands on his fortune. His office became the template for most contemporary, large American family offices.

Making It versus Keeping It

All family offices, including the Rockefeller’s, start for the same reasons. There’s a need to organize the personal side of an individual’s life and now there’s money to pay for help.

But as the family grows so does the stable of houses, cars, planes, travel, and staff. And taxes!

Entrepreneurs and business titans mostly made their money from shooting the lights out on a single venture. Blavatnik, Brin, Dell, Gates, Zell, Zuckerberg, went “all in” and won big. Their recipe? Highly-concentrated investments, risk-taking, innovation, and sheer audacity.

But preserving a legacy is different. Wealth is created by entrepreneurs, but maintained through diversification, sophisticated risk-management, and prudence. The psychological profile of the former does not easily transform to the latter.

Successful entrepreneurs build competitive advantage into their businesses, but that advantage doesn’t naturally transfer to diversified investing. It’s a different mind-set and a different set of skills.

Time and Money

The more complicated life becomes, the more issues there are to deal with.

Read More »Searching for the next Swensen

by charles | Comments are closed06/14/2021

Talent is a flame. Genius is a fire. — Bernard Williams

There is no place like America for exceptional investment talent.

Our country continues to produce and attract the world’s best and brightest and, along with Canada and Mexico, owns 58% of the world’s financial assets ($136 trillion) and collected 64% of all asset management revenues ($150 billion) in 2020. See: Boston Consulting Group Global Wealth 2021.

But with all our talent and resources, the challenge of building superior investment teams that can endure and outperform over a decade or more is daunting and seldom achieved.

Yale, Princeton, MIT, and Bowdoin have had a great run. Goldman Sachs and JPMorganChase have outlasted most of their peers.

And yet, while consistent, multi-decade superiority isn’t impossible, it’s exceedingly rare. Many redoubtable firms have just vanished.

There are a very few, semi-mythical beasts like the recently deceased Mr. David F. Swensen, Ph.D., Yale’s long-serving chief investment officer and Warren Buffett, of course.

Swensen built a process for identifying superior outside managers, cementing relationships, and staying with them as long as they were judged to have the edge. He was also an innovator with first-mover advantage in many respects which can’t be replicated.

One of my professors at The University of Chicago once remarked that some money managers seem to have the touch. And we can theorize, not always correctly, about how they do it. But most of them have a run bracketed by a certain period or a set of conditions, and then they are gone.

Even James Simons of Renaissance Technologies – the best trader ever – just had a losing year.

Why is this?

Paul Wachter, former investment chair of the University of California Regents, outlined the criteria used by the UC regents during their search in 2014 for a chief investment officer.

Mr. Wachter listed three principal qualities the UC board looked for in a candidate.

Organizational skills: Someone with serious organizational skills, who could work effectively with a big institution like the UC system.

Personality: Someone with the personality to work constructively with all of those different constituents, from the board and president to student groups.

Investment skill: But he added a caveat to number three.

Mr. Wachter said, “what you can’t tell in an interview is how good of an investor someone is. If you look at their track record in their previous position, you’re seeing the product of an entire team or institution.”

As readers of The Skorina Letter have no doubt noticed, we spend a great deal of time mining and analyzing the investment performance and pay of asset managers and chief investment officers. We look for skill and persistence and the data to support our search recommendations.

But, as Mr. Wachter points out, identifying a superior investment leader is not that simple.

Why?

Read More »A Block-buster Year for Pensions and Nonprofits

by charles | Comments are closed06/07/2021

Public pensions, endowments, and foundations will announce blow-out performance when returns are released this fall.

Thanks to bold moves and celestial markets the fiscal year ending June 30, 2021 will be a block-buster for the ages.

A little over a year ago, around March 2020 when markets fell off a cliff, veteran chief investment officers scrambled to rebalance and put their extra cash to work, a gutsy call but not without precedent.

Modern portfolio theory – and the 2009 crash – taught CIOs that when markets crater, investors big and small should rebalance (i.e., buy everything in sight).

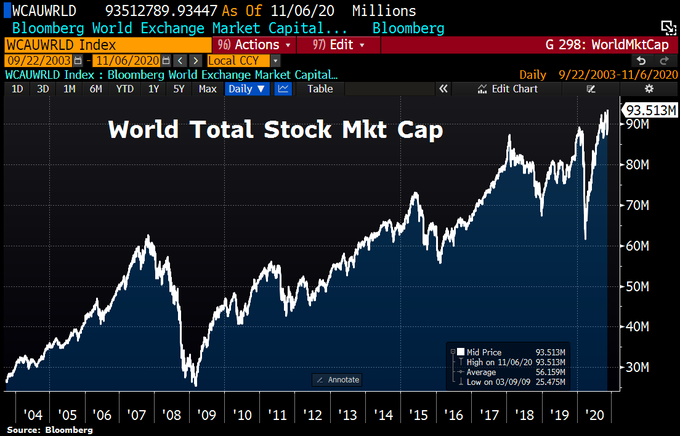

Experience, history, and luck were on their side. As of April 30, 2021, the S&P 500 has had a one-year total return of 45.98% and the Barclays Agg ETF returned a minus 0.27%, so a plain vanilla 70/30 portfolio scored about 32.1%.

As a result, equity-heavy, risk-on pensions will have their best returns in years. We could see thirty percent and more.

Endowment and foundation CIOs should do almost as well thanks to eye-popping, co-invested venture and private equity returns and good old-fashion leverage. E&Fs may hold less equity and more alts, but many private market pay-offs were extraordinary.

On the other hand, for those CIOs and investment committees who missed the 2009 memo and panicked — slashing equity exposure then belatedly rebalancing at much higher prices — things aren’t looking so good!

Sub-par returns don’t sit well with trustees and donors. There will be consequence.

CIO Turnover: Pink Slips and Greener Pastures

Poor performance is not the only reason for a rash of CIO departures over the coming year. Early retirement is in the air.

Many investment heads have grown accustomed to the no-commute, work-from-anywhere lifestyle during covid and they don’t look forward to rejoining what they left behind.

They saved their money, invested wisely, and now have a healthy retirement cushion. Many have told us privately that they plan to retire early.

Registered Investment Advisors hear the same thing. Over the past year we’ve spoken with over two-hundred RIAs and they say that among clients in their fifties, early retirement is the number one question on their minds. “I don’t want the commute, stress, and hassles any more. Do I have enough to retire now?

For those of us in the search business, it’s going to be a very busy year.

When the Music Stopped

Read More »